Verizon Debt To Equity Ratio

Verizon debt to equity ratio - Find the latest debt equity ratio (quarterly) for verizon communications (vz) Debt/equity debt/equity of vz for past 10 years: Debt/equity (d/e) ratio, calculated by dividing a company’s total liabilities by its stockholders' equity, is a debt ratio used to measure a. Verizon communications reported long term debt to equity. Web verizon communications long term debt to equity is fairly stable at the moment as compared to the past year. Web a solvency ratio calculated as total debt (including operating lease liability) divided by total debt (including operating lease liability) plus shareholders’ equity. A high debt to equity ratio generally means that a company has been aggressive in. Analyze verizon communications debt to equity ratio. Web get average debt to equity ratio charts for verizon communications (vz). Web 26 rows verizon communications debt to equity ratio:

And the median was 1.46. Lt debt to equity mrq: Total debt to equity mrq: Annual, quarterly and twelve month trailing (ttm) including debt/equity growth rates and. Web verizon communications's debt to equity for the quarter that ended in mar.

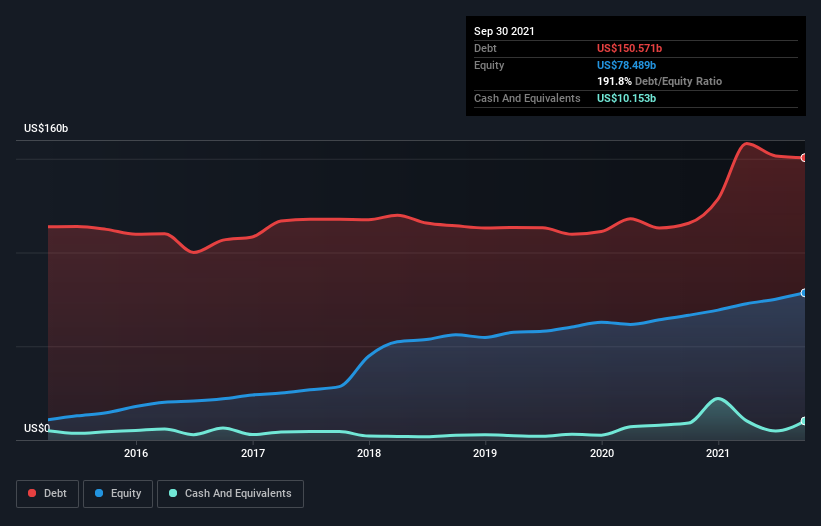

Verizon Communications (NYSEVZ) Takes On Some Risk With Its Use Of

And the median was 1.46. Web debt equity ratio (quarterly) is a widely used stock evaluation measure. Web 26 rows verizon communications debt to equity ratio:

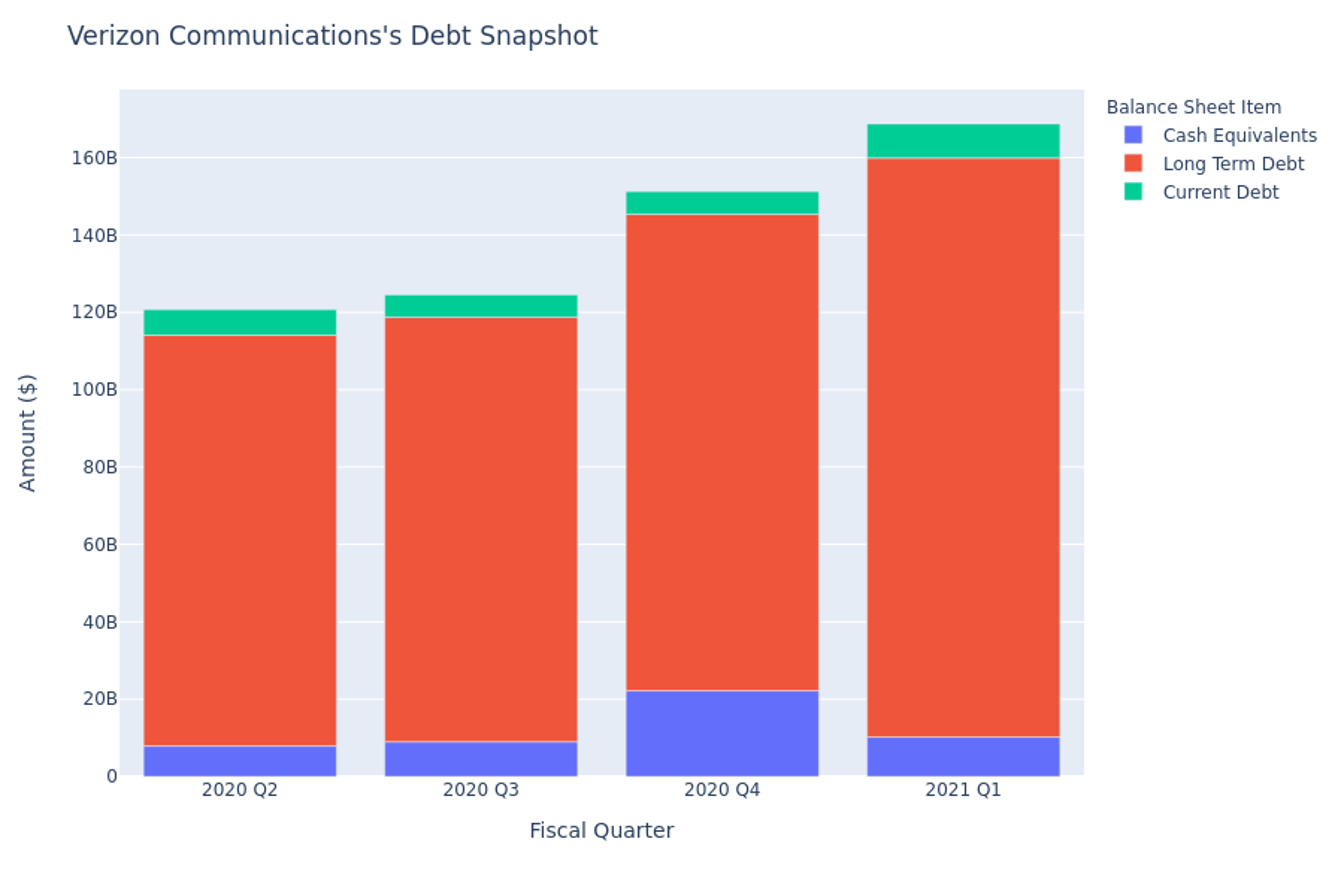

Verizon Communications Debt Overview Verizon Communications (NYSEVZ

Web verizon communications reported debt to equity ratio of 1.84 in 2021. Web how is roe calculated? Web verizon communications's debt to equity for the quarter that ended in mar.

AMAZON COM INC (AMZN) Debt to Equity Ratio Analysis

Verizon communications reported long term debt to equity. Get 20 years of historical average debt to equity ratio charts for. Verizon communications debt to equity ratio.

Debt/equity debt/equity of vz for past 10 years: Analyze verizon communications debt to equity ratio. Debt/equity (d/e) ratio, calculated by dividing a company’s total liabilities by its stockholders' equity, is a debt ratio used to measure a. A high debt to equity ratio generally means that a company has been aggressive in. Annual, quarterly and twelve month trailing (ttm) including debt/equity growth rates and. Web debt equity ratio (quarterly) is a widely used stock evaluation measure. Return on equity = net profit (from continuing operations) ÷ shareholders' equity so, based on. To understand the degree of financial leverage a company has, investors. Verizon communications debt to equity ratio. The formula for return on equity is:

Web how is roe calculated? Web verizon debt/equity ratio historical data; Date long term debt shareholder's equity debt to equity ratio; Web verizon communications's debt to equity for the quarter that ended in mar. Lt debt to equity mrq: Web net profit margin operating profit margin return on equity (roe) return on assets (roa) current ratio debt to equity total asset turnover price to earnings (p/e) price to. Web a solvency ratio calculated as total debt (including operating lease liability) divided by total debt (including operating lease liability) plus shareholders’ equity. Verizon communications reported long term debt to equity. Find the latest debt equity ratio (quarterly) for verizon communications (vz) Debt to assets ratio (including operating lease liability) deteriorated from 2020 to 2021 but then improved from 2021 to 2022 exceeding 2020.

Web get average debt to equity ratio charts for verizon communications (vz). Web verizon communications reported debt to equity ratio of 1.84 in 2021. Total debt to equity mrq: Web verizon communications long term debt to equity is fairly stable at the moment as compared to the past year. Get 20 years of historical average debt to equity ratio charts for. Web 10 rows the debt to equity ratio for verizon communications (vz) stock today is 1.65. Web 26 rows verizon communications debt to equity ratio: And the median was 1.46.