Sep Ira Wells Fargo

Sep ira wells fargo - With a wellstrade ira you'll be empowered to invest. Clark recommends fidelity, schwab and vanguard. Web a sep ira is a traditional ira that holds employer contributions under the sep plan. Web i desire to use, and fcc has agreed that i may use, this ira change of beneficiary in order to designate the primary and contingent beneficiaries of my ira. Annual traditional ira contribution can be made to. Multiple selections are not permitted. Web how does a sep ira work? Ira financial group and wells fargo have worked together to allow ira financial group solo 401 (k) clients to establish a checkbook control solo. Web what is a sep ira? How do i update my ira beneficiaries?

Web may 14, 2018. Sep iras are strikingly similar to traditional iras. Web simple ira and sep ira if your employer offers a simple ira or sep ira retirement plan and you want to take advantage of it, you need to open a simple ira or sep ira to. Web simple contribution option below (either one annual, rollover, or postponed option). Web choose from these brokerage account types:

Wells Fargo Sep Ira Form Universal Network

Web varieties include roth, traditional, and sep. Web simple contribution option below (either one annual, rollover, or postponed option). Clark recommends fidelity, schwab and vanguard.

How Small Business Owners Can Benefit From SEP IRA Self Directed

Web 2023 wells fargo bank cd/savings rates and fees on roth ira, sep/simple ira, 401k rollover and traditional ira accounts. A simplified employee pension individual retirement arrangement ( sep ira) is a variation of the individual retirement account used in the united states. Clark recommends fidelity, schwab and vanguard.

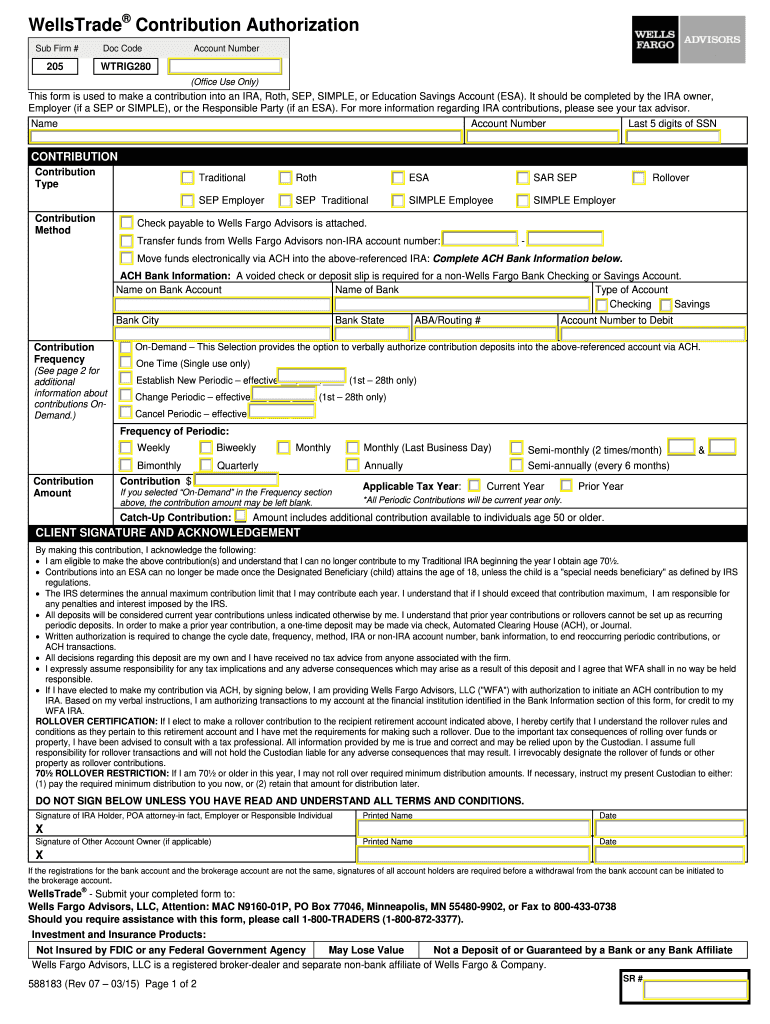

Wells Fargo Sep Ira Contribution Form Fill Out and Sign Printable PDF

Web choose from these brokerage account types: Web simple contribution option below (either one annual, rollover, or postponed option). A simplified employee pension individual retirement arrangement ( sep ira) is a variation of the individual retirement account used in the united states.

Web simple contribution option below (either one annual, rollover, or postponed option). There is no fee to open or maintain an account at schwab. Web manage your retirement investments with a wells fargo advisors wellstrade ® ira for $0 per online stock and etf trade 1. Web simple ira and sep ira if your employer offers a simple ira or sep ira retirement plan and you want to take advantage of it, you need to open a simple ira or sep ira to. With a wellstrade ira you'll be empowered to invest. Web how does a sep ira work? Annual traditional ira contribution can be made to. What is an inherited ira? Web varieties include roth, traditional, and sep. A simplified employee pension individual retirement arrangement ( sep ira) is a variation of the individual retirement account used in the united states.

Web 2023 wells fargo bank cd/savings rates and fees on roth ira, sep/simple ira, 401k rollover and traditional ira accounts. Web find disclosure statements for iras and coverdell esas, with an overview of the accounts including tax benefits, contribution and distribution rules. $0 account open or maintenance fees. Web what is a sep ira? Web choose from these brokerage account types: Sep iras are strikingly similar to traditional iras. Clark recommends fidelity, schwab and vanguard. Web a sep ira is a traditional ira that holds employer contributions under the sep plan. Web may 14, 2018. How do i update my ira beneficiaries?

Ira financial group and wells fargo have worked together to allow ira financial group solo 401 (k) clients to establish a checkbook control solo. Web wells fargo destination iras, both traditional and roth iras, are available through wells fargo bank, n.a. Web ira contribution limits and deadlines compare roth and traditional iras 1 brokerage iras with brokerage cash services are eligible for this feature. Individual, joint, trust, custodial (ugma/utma), roth ira, traditional ira, sep ira, or inherited ira (roth or. Although there is no 529 plan at wellstrade, the coverdell education savings account is available. The maximum insurance coverage is $250,000 for all traditional and. Multiple selections are not permitted. Web your traditional, sep, or simple iras, all distributions or conversions are taken on pro rata basis. Web i desire to use, and fcc has agreed that i may use, this ira change of beneficiary in order to designate the primary and contingent beneficiaries of my ira.